Debt Receivable

The Medium Small and Micro Enterprises are governed according the MSME Act, 2006.

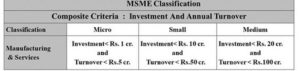

MSME’s are classified into 2 main broad categories:

1. Manufacturing Enterprises: Enterprises engaged in the manufacture or production of goods or employing plant and machinery in the process of value addition to the final product having a distinct name/character of use.

2. Service Enterprises: Enterprises engaged in providing or rendering services and are defined in terms of investment in equipment.

Since 2018 MSME’s are being defined according to their annual turnover.

DEBT RECOVERY UNDER THE MSMED ACT

The Chapter V of MSMED Act contained the provisions with regard to the Recovery of the Outstanding from the Buyer in case of any service(s) availed or good brought by him

• Section 15: It provides that buyer to make payment in case of any service(s) being availed or good brought by him on or before the date as agreed in writing otherwise before the appointed date [The maximum period to be paid to the seller is 45 days from the day of acceptance or deemed acceptance]

• Appointed date means the day following immediately after the expiry of the period of 15 days from the day of acceptance or the day of deemed acceptance of any goods or any services by a buyer from a supplier.

• Day of Acceptance means: (a) the day of the actual delivery of goods or the rendering of services; or (b) where any objection is made in writing by the buyer regarding acceptance of goods or services within 15 days from the day of the delivery of goods or the rendering of services, the day on which• such objection is removed by the supplier;

• Day of Deemed Acceptance means, where no objection is made in writing by the buyer regarding acceptance of goods or services within fifteen days from the day of the delivery of goods or the rendering of services, the day of the actual delivery of goods or the rendering of services.

• Section 16: Buyer shall be liable to pay compound interest with monthly rests in case of failure to comply with the aforesaid provision. Interest Rate will be 3 times of the bank rate notified by the RBI.

• Section 17: Buyer to make payment along with interest.

• Section 18: MSME make a reference to the Micro and Small Enterprises Facilitation Council (“MSEFC”) and MSEFC may initiative on its own, action as it may deed necessary.

Main objectives of MSMED Act 2006 with regards to Debt Recovery:

• Statutorily bind the buyer to pay the MSME supplier within the statutory due date (within 45 days of the acceptance of the goods/service rendered)

• Provide for penal interest statutorily in case buyer defaults in making payment (The buyer is liable to pay compound interest with the monthly rests to the supplier on the amount at the three times of the bank rate notified by RBI)

• Provide for efficient statutory mechanism for expeditious resolution of supply and payment related disputes.

• Statutorily ensure to recover at least 75% of the due amount along with interest for disbursal of finance to the MSME supplier to keep it viable in case buyer appeals in court [Please note that if the Appellant (not being the supplier) wants to file an appeal, no application for setting aside any decree or award by the MSEFC shall be entertained by any court unless the appellant (not being supplier) has deposited with it, the 75% of the award amount] – The objective of the remedy at Section 19 incorporating mandatory deposit of 75% amount in terms of the Award to entertain the appeal/ contest by the Buyer under Section 34 of Arbitration Act by the Buyer in the Court is in order to ensure timely flow of finance to MSME supplier so as to remain viable in the event of delay, default or dispute regarding payment by the buyer. The object of effective and expeditious remedy incorporated at Section 18(5) and section 19 of MSMED Act 2006 is to be appreciated by reading together with Section 34(3) and Sec. 36 of Arbitration Act. The remedy and relief can be fairly deducted to securing at least 75% amount and disbursing that amount through Court to MSME supplier within six (6) months with the intent to retain its viability and financial health and to reduce incipience of sickness.

The benefits under MSME :

• Faster and most affordable process for the MSME-vendors

• Most beneficial as MSME-vendors are mainly Operational Creditors.

• Filing of cases can be made through online portal – MSME SAMADHAAN

• The total amount due along with interest accrued during the period can be obtained without limiting to the Resolution plan and Liquidation Amount.

• Defaulter approaching for appeal must deposit 75% of the Award amount prior to filing of appeal.

• MSME can check the status through online portal

Keeping in mind the growing need to safeguard the MSMEs and encourage growth, it must be taken into consideration that MSMED Act could provide a progressive step towards financially stabilizing these entities during this tough time. The suspension of the trigger clauses in the IBC for about six months as proposed may not be sufficient and looking at it from a practical angle, there could be an extension of this period. If that is the case then it becomes only logical that the MSMEs take recourse under the MSMED Act for sustenance and stability. This sector as it is has several challenges and should be protected from being pushed into unwarranted litigation and hence the process set up under the Act itself has to be strengthened; made very effective and most importantly strong at execution to help out the sector.

Following is the procedure to file a case on the MSME Samadhaan portal – a delayed payment monitoring system:

• Access the MSME Samadhaan portal at samadhaan.msme.gov.in/.

• Enter your Udyog Aadhaar Number and mobile number as in the Udyog Aadhaar. Fill verification code as displayed and then click ‘validate udyog aadhaar’ button. You will get an OTP on your email. Fill the OTP and start filing the case.

• In case you have not registered under Udyog Aadhaar, then first register yourself at udyogaadhaar.gov.in and start filing the case on MSME Samadhaan Portal.

• You should have maximum three work order and three invoices in PDF to be uploaded on the portal. File size should not exceed 1MB.

• You can check status of your case by entering udyog Aadhaar Number or application number.

MSME AND ARBITRATION

The primary objective of Micro Small Medium Enterprises Development Act, 2006 is to provide for facilitating the promotion and development and enhancing competitiveness. The MSME Act mandatorily requires a buyer of goods/services from a MSME to make payments within 45 days else subject to a steep rate of interest. S 18 contains a provision where reference can be made to the MSME facilitation council for Conciliation and if it turns out to be unsuccessful then take the dispute to arbitration or refer the parties to an arbitral institution.

In case of dispute between parties where one of the parties is a supplier, if the supplier invokes the jurisdiction of the Council first then the provisions of the MSME Act would be applicable to the dispute. But if the Buyer invokes arbitration first under the contract between parties, the provisions of the MSME Act may not be applicable to such arbitration proceedings. This essentially means that if the Buyer wants to avoid Arbitration under the MSME Act, it merely has to pull the trigger first and invoke arbitration under the contract before the Supplier invokes jurisdiction of the Court.

Under the MSME Act appellants have to deposit 75% award in order to appeal whereas in Arbitration and conciliation Act the amount to be deposited is 100% and therefore it is only a matter a careful consideration as to which procedure should be chosen.

USEFUL LINKS:

http://www.ipface.org/pdfs/schemes/MSMESchemes-OriginalDocument.pdf

https://msme.gov.in/ip-facilitation-centre-msme

http://www.dcmsme.gov.in/schemes/IPRDetail.html

http://www.dcmsme.gov.in/emerge/intpr.htm

https://economictimes.indiatimes.com/small-biz/sme-sector/why-msmes-should-treat-intellectual-property-rights-as-assets/articleshow/69304077.cms?from=mdr

https://www.wipo.int/edocs/pubdocs/en/wipo_natstudy_sme_india.pdf

https://www.altacit.com/publication/msmes-and-intellectual-property-rights/